Dutch Freighter Grounds During Arctic Route Passage

Dutch freighter Thamesborg runs aground in Canada’s Franklin Strait, spotlighting the persistent risks of Arctic shipping through the Northwest Passage.

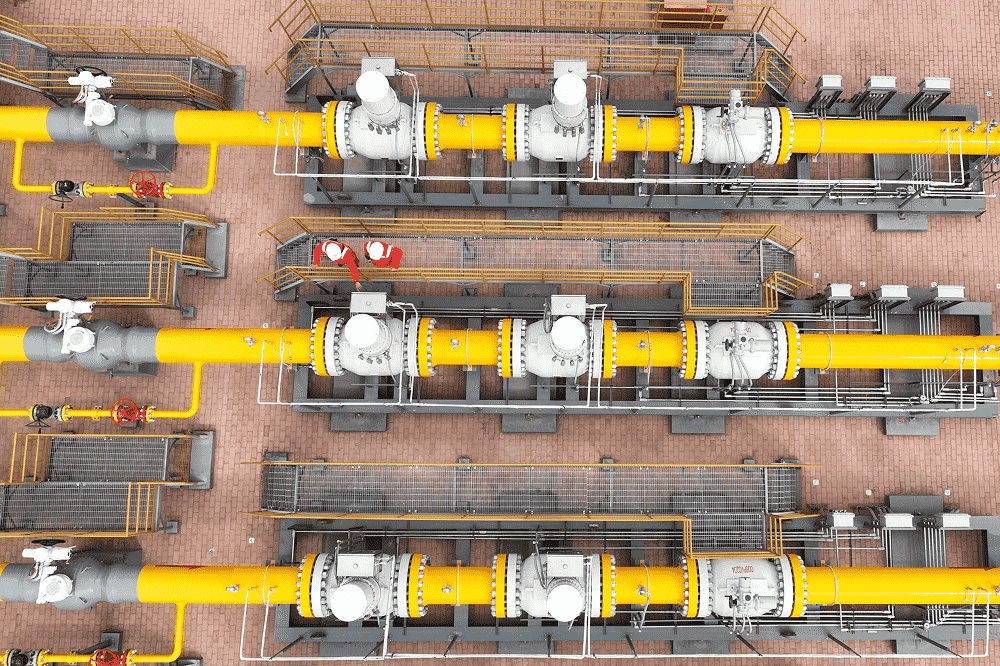

A new Siberia-to-China gas pipeline could reroute billions of cubic meters away from the global LNG fleet.

Russia has signed off on a major pipeline agreement with China that could reshape the LNG shipping landscape for years to come. The Power of Siberia 2 project, a 50 billion cubic meter per year pipeline running through Mongolia, will significantly expand Gazprom’s overland gas supply to China, potentially sidelining a sizeable portion of seaborne LNG volumes.

The deal, finalized in Beijing, marks a strategic pivot for Moscow following the collapse of its European gas trade post-Ukraine invasion. For Beijing, it secures discounted long-term energy supply, while for the LNG shipping sector, it raises fresh concerns over future demand for long-haul tonnage.

The pipeline’s projected capacity rivals that of the Nord Stream system, and when combined with the existing Power of Siberia line (which currently moves 38 billion cubic meters annually and could be expanded to 44 billion) Russia’s total pipeline exports to China could reach 94 billion cubic meters per year. That figure represents nearly 10 percent of today’s global LNG volumes and 6 to 7 percent of expected 2030 levels, according to analysis from SEB, the Swedish investment bank.

While Chinese LNG imports are not expected to vanish, the shift toward pipeline gas could crowd out volumes from key exporters such as Qatar, the United States, and Australia. This poses a challenge for LNG carrier operators including BW LNG, GasLog, and Flex LNG, whose vessels have long relied on China’s voracious appetite for long-haul cargoes.

A report from Rystad Energy earlier this year projected China’s LNG demand to grow steadily through 2030, but warned that pipeline gas could increasingly compete with seaborne supply, especially if geopolitical and pricing dynamics favor overland routes. The Siberia-Mongolia corridor, once operational, will offer China a politically stable and cost-efficient alternative to maritime imports.

The LNG shipping market has already begun to price in the long-term implications. Charter rates for TFDE and ME-GI vessels have softened slightly in recent months, and brokers report a more cautious tone among owners looking to expand fleets. While spot demand remains robust, particularly in Europe and South Asia, the China corridor could dampen future newbuild appetite.

Shipowners with exposure to Chinese routes are reassessing deployment strategies. Vessels such as the BW Pavilion Leeara and Flex Resolute, which have previously run Qatar-China routes, may see reduced utilization if pipeline volumes displace cargoes. Analysts suggest that tonnage could be redirected to emerging markets in Southeast Asia or Latin America, though volumes there remain comparatively modest.

The Power of Siberia 2 deal underscores a broader shift in global gas flows, one that could recalibrate LNG trade lanes and reshape fleet economics. For now, shipping professionals are watching closely as the pipeline inches closer to reality.